Editor's note: A version of this article ran in the March edition of Bicycle Retailer & Industry News.

HO CHI MINH CITY, Vietnam (BRAIN) — If the U.S. imposed reciprocal tariffs, it would create higher U.S. import tariffs on bikes and e-bikes from Vietnam, a key sourcing nation for the industry in recent years, although Vietnam imports relatively few U.S. bike products.

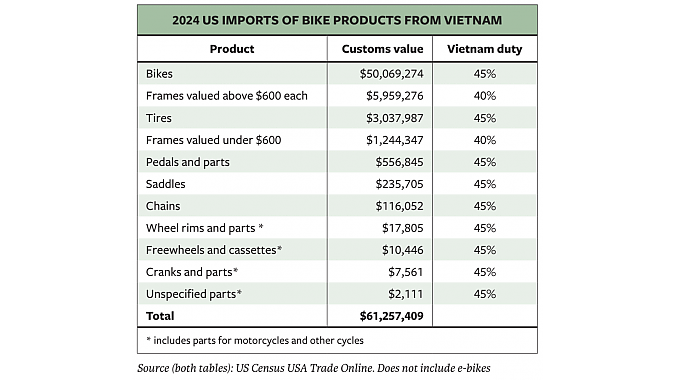

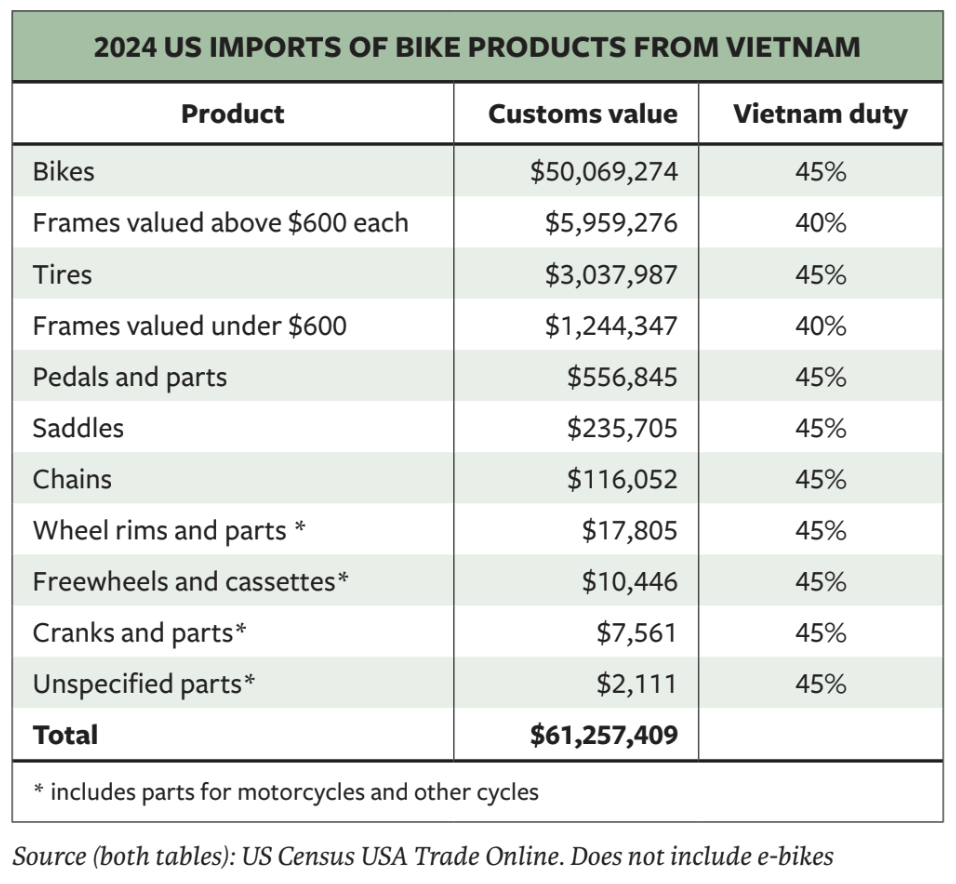

President Donald Trump has plans to impose tariffs on imports from other nations that equal those nations' tariffs on U.S. products as soon as April 2. When it comes to bikes, most nations have relatively low duties on U.S. products, so the reciprocal action would have little direct impact on the U.S. industry. Vietnam is an exception, with current tariffs of 45% on U.S. bikes and 55% on U.S. e-bikes. Vietnam imposes tariffs of around 45% on most other bike parts and accessories from the U.S.

Vietnam's consumer market for non-utilitarian bicycles is quite small. But the mixed socialist-oriented market economy does import some U.S. bicycle products. And one of that country's largest importers for the domestic market told BRAIN he would welcome reciprocal tariffs if they led to a new trade deal and reduced Vietnam's current high import duties on U.S. products.

Vietnam's consumer market for non-utilitarian bicycles is quite small. But the mixed socialist-oriented market economy does import some U.S. bicycle products. And one of that country's largest importers for the domestic market told BRAIN he would welcome reciprocal tariffs if they led to a new trade deal and reduced Vietnam's current high import duties on U.S. products.

Daniel Haziza is a Canadian who has lived in Vietnam for the last 22 years. His company, Premium Distribution, imports products from Trek, SRAM, Giro, Crankbrothers and other U.S. brands, serving about 100 active bike shops out of an estimated 300 specialty dealers in the country.

Of course, most of the U.S.-based brands that Haziza imports and distributes have their products made in Asia, so they are not subject to Vietnam's current duties on U.S. goods. In fact, Vietnam has free trade with most neighboring and non-neighboring nations — its relatively high tariffs on products from the U.S. and Taiwan are the exceptions.

But Haziza imports Trek ProjectOne bikes made in Wisconsin, Zipp wheels made in Indiana, and U.S.-made GU nutritional products. Vietnam's tariffs on U.S. products keep Haziza wary of importing more from the U.S. The tariffs make U.S. products non-price competitive with products made elsewhere, and Haziza and his bike retailer customers would have to compete with U.S. products that come in to the country under its de minimis rule (which is 1 million Vietnam dollars, about $40) or other duty-free channels, legal or not.

"I've talked to Chris King, I've talked to Cane Creek and ENVE," Haziza said, referring to brands that manufacture in the U.S. "But there's no way we could be price competitive here now."

Haziza also noted that Vietnam levies its U.S. tariff on products shipped from the U.S. to Vietnam even if they are made elsewhere. So for example, if Giro gloves made in the Philippines were warehoused in the U.S. before being sent to Haziza, they would be hit with the same tariffs as if they were made in the U.S. (currently 25% for gloves).

So if Trump imposed a reciprocal tariff that led to negotiations lowering duties on both sides, it would benefit Haziza's business, lowering his costs and opening up more product lines.

"That's why we were excited that the U.S. was going to join the TPP," Haziza said, referring to the Trans-Pacific Partnership free trade agreement. "For me the benefits of lower trade barriers would be great for business."

Background

The TPP agreement between 12 countries was signed by President Barack Obama but never ratified by Congress; Trump abandoned the deal in his first week in office in 2017. That decision left Vietnam and the U.S. in an unusual position.

Traditionally developing nations under the World Trade Organization have enjoyed protected domestic markets while they developed local manufacturing. As the nations developed, they moved toward free trade agreements.

Traditionally developing nations under the World Trade Organization have enjoyed protected domestic markets while they developed local manufacturing. As the nations developed, they moved toward free trade agreements.

Vietnam, as noted above, now enjoys free trade with most of the world — except the U.S. After the U.S. abandoned TPP, the remaining countries including Vietnam agreed to the Comprehensive and Progressive Agreement for Trans-Pacific (CPTPP) agreement, which took effect in 2019.

Because of Vietnam's bilateral trade agreements with the EU and other regions, it is no longer one of the developing economies that had enjoyed preferential trade agreements with the U.S. under the GSP (Generalized System of Preferences). That's somewhat irrelevant because GSP expired in 2020, but the bike industry and others have hopes that it will be renewed. Cambodia, Thailand and the Philippines, significant suppliers to the U.S. bike market, remain GSP nations that would regain preferential treatment if the program is restored.

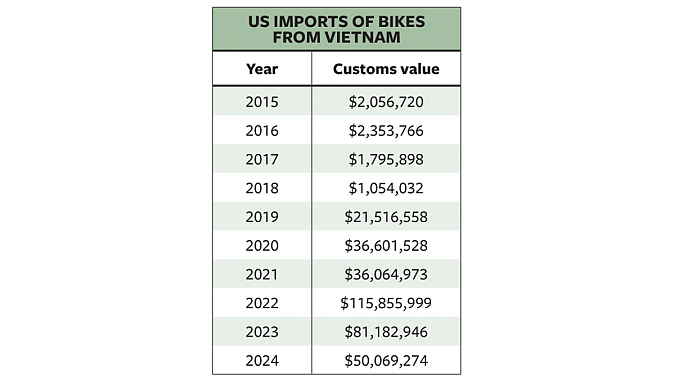

As the charts on this page show, the U.S. imported about $50 million worth of bikes from Vietnam last year, plus at least another $10 million in parts and accessories. The number is actually larger as it's impossible to count some categories via government import statistics because e-bikes, cycling apparel, helmets and small parts do not have bike-specific import codes.

If the U.S. reciprocated Vietnam's duties in 2024, it would have cost the industry $22.5 million in new tariffs on bikes alone.