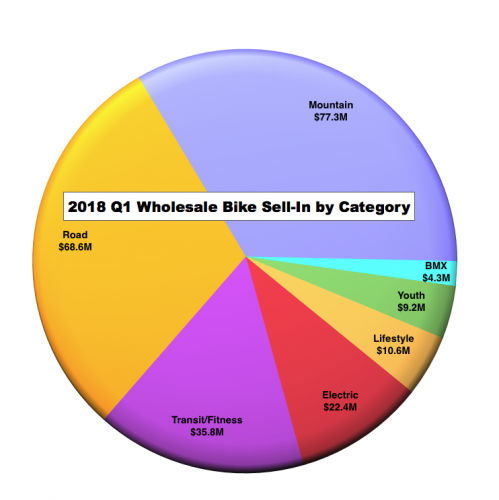

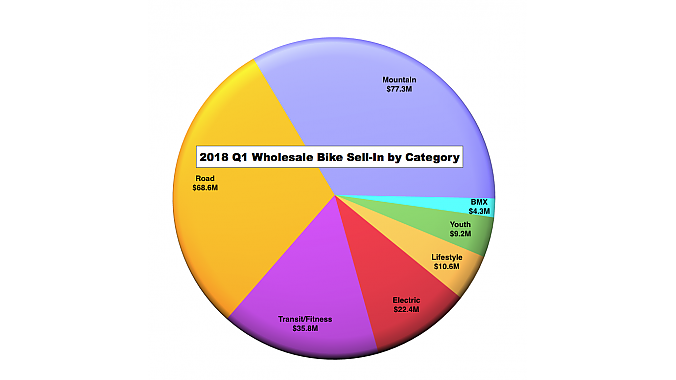

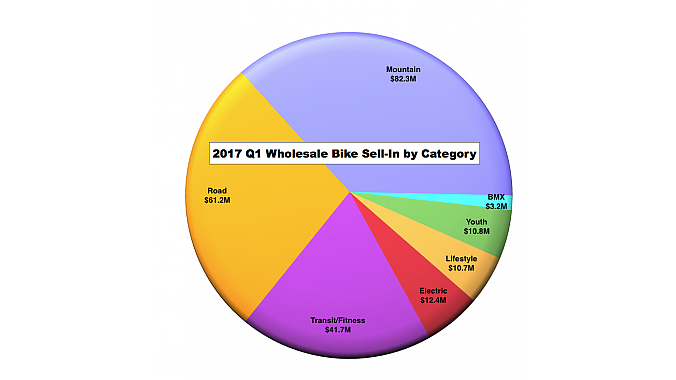

BOULDER, Colo. (BRAIN) — The U.S. bike industry saw a slight uptick in wholesale sell-in in the first quarter, driven by increases in sales of e-bikes, gravel bikes, and BMX. The dollar value of the bikes sold in to retailers in the first quarter was $229 million, up 2.4 percent from the same period last year.

In unit sales, the industry saw a decline of 9.3 percent in the quarter, with the steepest decline seen in the transit/fitness bike segment, which was down nearly 21,000 units compared to the first quarter in 2017.

The numbers are from the Bicycle Product Supplier Association's quarterly sell-in report compiled by The NPD Group.

As has been the case for several years, e-bike sales bolstered the report. Electric bikes accounted for 9.8 percent of all wholesale bike sales in the first quarter, up from 5.5 percent of the total market in the same quarter last year. Wholesalers sold in 11,562 of the bikes, worth a total of $22.4 million, or an average of $1,941 per bike. In the big picture, the high average price of e-bikes helped offset the unit decline in the transit/fitness segment, were the average unit price is just $311.

Of the bike categories tracked, e-bikes have the third highest average price, behind 29-inch mountain bikes (average price $2,245) and triathlon bikes (average price $2,191). However, the 29er and triathlon categories are both relatively small and both were down in the first quarter, while the e-bike category was up 81 percent in dollars and 86 percent in units.

Other subcategories that showed strength were road bikes the BPSa categorizes as "Other" and "Cyclocross," which includes varied multi-surface drop bar bikes (there is not a "gravel bike" category). Together these two subcategories saw $28.9 million in wholesale sales in the quarter, up from $10.1 million last year. Other road subcategories were down, with the critical Men's Road category down 15 percent in dollars and 25 percent in units. But thanks to the growth in Other and Cyclocross, the overall road bike category was up 12 percent in dollars and flat in units, totaling $68.6 million dollars.

The mountain bike category as a whole was down 6 percent in dollars and 12 percent in units. Just two mountain bike subcategories saw growth: 27.5 inch bikes, up 9 percent in dollars and down 1.4 percent in units; and 29-inch/27.5-plus bikes, up nearly 50 percent in dollars, but still a very small category, with only 2,100 units counted this year. The overall mountain bike category totaled $77.3 million, still the largest of the major categories.

BMX also continued its resurgence, with dollar sales up 38 percent and unit sales up 29 percent in the quarter. With an average unit price of just $244 and with 16,600 units sold, BMX remains a relatively small part of the pie, with the category's sales totaling $4.3 million.