There is a truism in journalism known as Betteridge's Law of Headlines. It states, more or less, that "Any headline ending with a question mark can safely be answered with the word no."

The present headline isn't one of them. It ends in with a question mark because we really don't know. At least not for sure.

I've reviewed the notion of dealers going out of business a number of times in the past: specifically in December of 2023, more recently in May of 2024, and reaching back as far as 2019. My colleague Ray Keener tackled the same question even earlier.

Both Keener and I worked with Christopher Georger's company, Georger Data Services. And each time we (and Georger) have concluded that, while some retail businesses may indeed be getting out of the cycling game, they're being replaced at about the same rate by new businesses.

Be that as it may, those pieces didn't answer the Big Question of whether bike shops — or industry suppliers, for that matter — are failing at an accelerated rate versus historic norms. All we know for certain is that the overall population of dealers is pretty much constant and is even growing, thanks largely to the ongoing influx of new e-bike-only retailers, even though many of these businesses are not bike shops in the traditional sense.

The dealer drill-down

Common sense tells us that some large number of these bike shops — just for purposes of discussion, let's say it's 500 or more — have gone out of business entirely in the past year.

I reached out to Christopher Georger, owner of Georger Data Services and The Bike Shop List, to see if he could provide any absolute numbers on dealers who appeared on one or more of the sixty-odd bike brands' dealer lists he tracks in December of 2023 but were absent from all listings by December 2024.

Georger emphasizes that his source material includes REI stores. Dick's Public Lands stores are likewise included, but not other Dick's locations. Scheels stores listed in Trek's dealer locator are included. And Beeline-only dealers are included, as are listed Yamaha dealers.

Of the nearly 7,700 total shops listed by GDS as of December 2024, some 770 are new, having appeared for the first time within the previous twelve months. About 200 of these carry electric-only bike brands.

But nearly 650 shops that were listed 12 months previous no longer show up any of the dealer locators that GDS tracks.

To be sure, the fact that these retailers no longer appear in Georger's lists does not necessarily mean they have gone out of business. They could have changed names as a result of being purchased by Trek, Specialized or Pon ... or by another retailer, for that matter. They may still be in business, but have transitioned to a service-only model. They may have moved to a new location. Or they may be a single closed-down branch of a ongoing multi-store operation.

But common sense (not to mention Occam's Razor) tells us that some large number of these bike shops — just for purposes of discussion, let's say it's 500 or more — have gone out of business entirely in the past year. Shut down for good, locked the door, and walked away.

That's a lot of failed dealers.

Since this is the first time Georger has crunched this particular set of data, there's no good way of knowing whether the 2024 number is unusual. But my experience tells me the median number of shops going out of business in a "typical" (which is to say, pre-covid) year would be more on the order of a couple hundred, not more than double that amount.

Anecdotally, there's certainly some evidence to back up that conclusion. The problem is that shops going out of business tend to do so quietly, and the news seldom goes beyond the local market that is affected. But thanks to social media, local events can get out to the larger population.

Members of the Facebook cycling group (disclosure: I'm the admin) has been posting what seems like one or two articles per week for the past several months about bike shop failures from local media sources in cities all across the country.

One commenter claimed that Portland — certainly one of the top bike towns in the United States — has consolidated from more than 70 bike shops a decade ago to 49 today. If so, that would be a 30% drop in retail bike businesses over 10 years.

Finally, I talked to retailer Randy Hall, who owns two successful Bicycle Connection shops in Delaware, featuring Trek/Electra and some closeout brands. But Hall also has a side hustle, helping cycling industry suppliers and retailers offload excess or unwanted inventory. These may be extant shops that just have more product than they need, but increasingly post-COVID, he says, his clients have been "almost exclusively" shops going out of business.

So, back to the question posed in the headline, have retailer businesses started failing at unusually high rates? It certainly seems possible, and, depending on how you read the available evidence, perhaps even likely.

And it's not just dealers, either

"115 bicycle brands have left the U.S. market in 2024. This dramatic increase in closures represents a greater than four times the volume of closures in 2023." —Peter Woolery, Bicycle Marketing Research LLC

Tough times — and with them, business failures — have hit the supplier side of the cycling industry as well. In addition to Kona (which, to fair, quickly reestablished itself under original founders Dan Gerhard and Jake Heilbron) and Rocky Mountain (which is restructuring), there's Diamondback, Redline, iZip, Raleigh and, most recently, GT. With the exception of Kona and Rocky Mountain, all these bike brands are currently "paused," which seems to be the catchphrase du jour for a brand that's not completely dead, but isn't shipping (or buying) any new product for the foreseeable future, either.

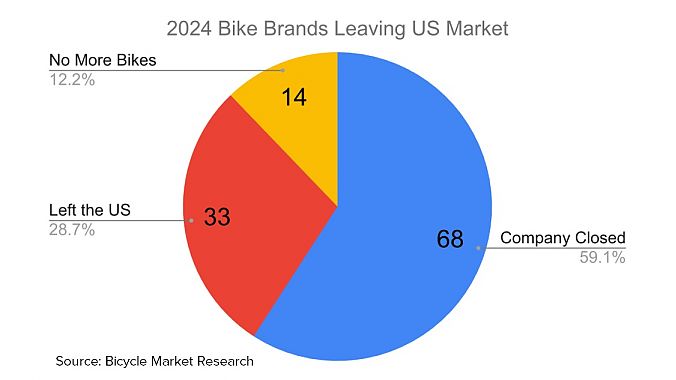

Industry boffin and self-described data geek Peter Woolery has been keeping track of all this. In a recent blog post to his website, Bicycle Marketing Research, Woolery says, "115 bicycle brands have left the U.S. market in 2024. This dramatic increase in closures represents a greater than four times the volume of closures (25) in 2023."

In the wake of massive discounting at or below supplier cost beginning in late 2023, Woolery says, many smaller brands did not have robust financials necessary to weather the industry-wide storm and were forced to close operations. He also points out that while large organizations often have the resources to restructure, smaller brands have less recognizable IP, which leaves them with more limited options.

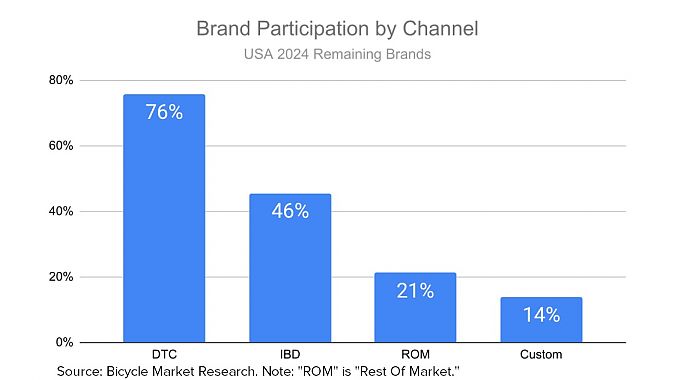

Of the 115 brands forced to close, Woolery says, "about 60%," were e-bike suppliers. He showed me the list of failed brands with the request that BRAIN not publish it, but in reading through the file, it seemed to me that many of the failures were for lesser-known, discount D2C e-bike brands (see second chart previous).

I asked Woolery about his basis for declaring a brand dead. He responded with a list of seven criteria, one or more of which would be sufficient to consider the company being out of business in the U.S. These ranged from public announcements or actual bankruptcy filings to D2C websites going offline, having no more U.S. retailers or distributors listed, or with no inventory available on the site.

For all that, he told me in an email exchange, "there are lots of edge cases and brands that come back under new ownership. I try to keep up with those and adjust for them."

In conclusion, Woolery's blog post says, "it is likely that 2024 represented a peak of brand closures. 2025 may still exceed 2023, but I expect it to fall well short of the 115 brand exodus we saw in 2024. There are some early signs of life with used bike prices beginning to recover, and unit inventories reaching normal levels. If brands can digest more of their high dollar inventory, they will be in a better position as the market turns."

To which I can only reply with a heartfelt "amen." With certain notable exceptions, like a relatively few retail markets (Boston, for instance) and a handful of relatively healthy bike brands (Marin comes to mind), 2024 was a brutally tough year for just about everyone in our quirky little industry.

So no promises, but here's hoping 2025 brings us something better.