2023 was the year that everyone is trying to forget. Inventories were way up, sales were way down, and relations between suppliers and retailers were way more strained than anyone can remember. And, as I pointed out last month, things aren’t likely to get much better anytime soon.

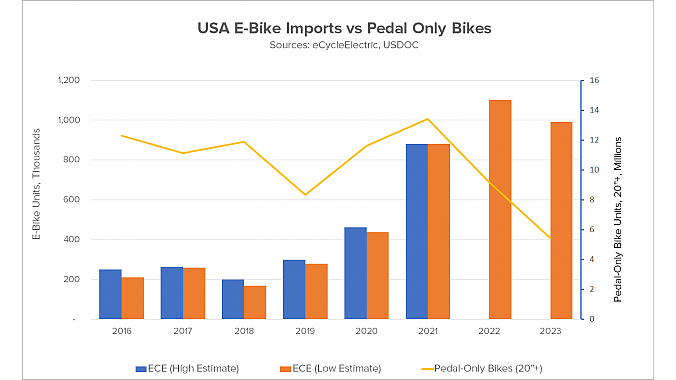

In the midst of all this, the chart below provides a little bit of factual context in the form of the 2023 import numbers for e-bikes (courtesy of Ed Benjamin’s eCycleElectric consultancy) and pedal-only bikes with wheel sizes 20-inches and up (courtesy of the March issue of BRAIN, but ultimately from the U.S. Department of Commerce).

Imports are down, and they’re still too many

The 2023 number of 5.4 million represents the all-time lowest number of pedal-only imports since 1981.

The first thing you’ll notice in the first chart is that import numbers for both classes of bikes fell significantly in 2023 as suppliers tried desperately to turn down the faucet of orders in the pipeline, and apparently achieved at least some success in doing so.

Pedal-only bike imports for 2023 were down by a whopping 41% from 2022, which itself was down just over 31% from 2021. The 2023 number of 5.4 million units represents the all-time lowest number of pedal-only imports since 1981, which is as far back as my numbers go.

By way of comparison, e-bike imports were 990,000, down just 10% from 2022, which represented a 25% increase from 2021.

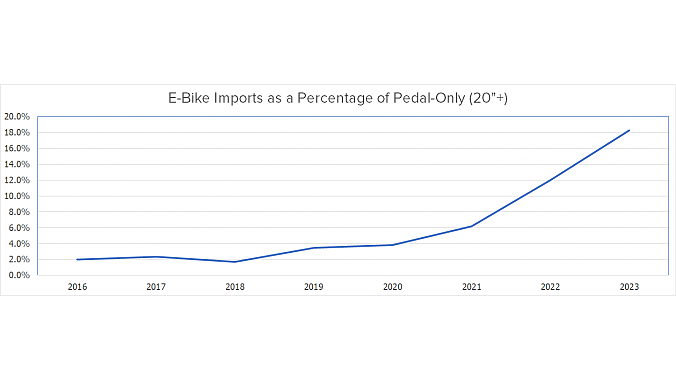

Not only that, but e-bikes are steadily gaining market share, from an insignificant 2% in 2016 to more than 18% of pedal-only bike sales in 2023. Clearly the gain in 2023 is largely due to the huge cutbacks in pedal-only bike imports, but the result is remarkable nonetheless.

Some have speculated that when e-bike imports reach 20% of pedal-only, it will mark an inflection point for e-bike sales in the U.S., and that some large increase in market share (the hockey-stick curve) will happen as a result. I am skeptical of this projection. Here’s why: some large majority of e-bike sales are in the very bottom of the mass market as low-end bikes shipped D2C from China and other Asian manufacturers. These units have no direct parallels in the pedal-only market segment, so there’s no basis for an apples-to-apples comparison, which renders that 20% number arbitrary. To really see the relationship, we’d have to look at dealer and mass retailer sales and filter the bottom feeders out of the equation somehow. At present I don’t believe the industry has the resources to do this.

New room, same elephant

Our current inventory crisis is a long-term problem, and long-term problems tend not to have short-term solutions.

All the foregoing raises an interesting question: If we cut back our imports so much in 2022 and 2023, why do we still have so much excess inventory in 2024 and even into MY 2025? The answer, of course, is that we brought in enormously too much inventory during the COVID years, as far back as 2020 and 2021. And we’ve been choking on that inventory ever since. Which is to say our current inventory crisis is a long-term problem, and long-term problems tend not to have short-term solutions, however much we may want them.

The only bright spot in this otherwise gloomy picture is that e-bikes, at specialty retail price points, anyway, seem to be doing rather better than other product categories. In an informal poll on the Facebook group Cycling Industry Recovery, 56% of retailers responding reported that their e-bike sales are up relative to their pedal-only models.

Perhaps that’s a sign of things to come.