Make no mistake: when it comes to bikes, we are still very much a dealer-driven industry. Absent pure D2C labels like Canyon, the enormous majority of both brand prestige and sales dollars for most bike companies comes down to the strength of their dealer networks.

Of course some dealers are more desirable than others. But overall, you need a critical mass of retailers to cover all the major and minor markets in this country or you miss out. Overall brand success does not come from advertising. Not from race teams. Not from a website. Not even, solely, from how competitive your products are. At the end of the day, it's retailers that make the difference between a top-selling brand and an also-ran. Of course those other items I've listed also impact your appeal to dealers. But the bottom line is clear: Gain more dealers over time, your brand strengthens. Lose them, and you weaken. All of which makes the size of a brand's dealer network one good indicator of its overall health.

Christopher Georger's company, Georger Data Services, keeps track of those indicators. For more than a decade, GDS has harvested bike brands' dealer lists to see who's selling what. And periodically, he shares some of that information with BRAIN.

Georger has been developing "The Bike Shop List" for more than 20 years and has over 7,000 addresses for shops offering bicycle-specific products including e-bikes.

One useful bit of information is what Georger calls his "OPB," or Other Popular Brands — that is, important brands beyond Trek, Specialized Giant, and Cannondale. To make the OPB list, the count of locations is a fact that changes over time, but how the shop considers a brand in their overall offerings and priority is just as important.

Sun Cycles, for instance, lists every dealer who's ever bought a bike from them, more than 2,000 shops in total. Another brand, who shall remain nameless, bought the GDS Bike Shop List and used it as their Dealer Locator base. Neither of those brands made Georger's OPB list.

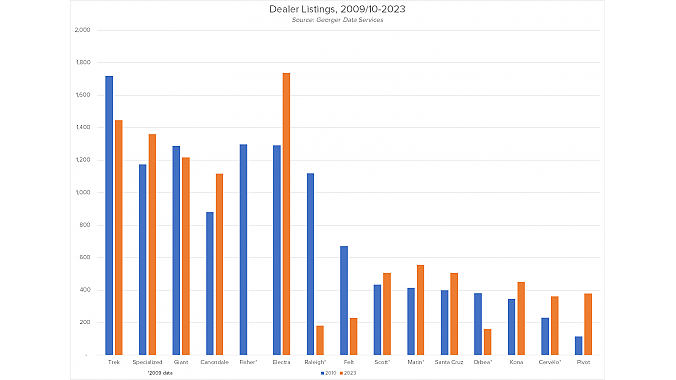

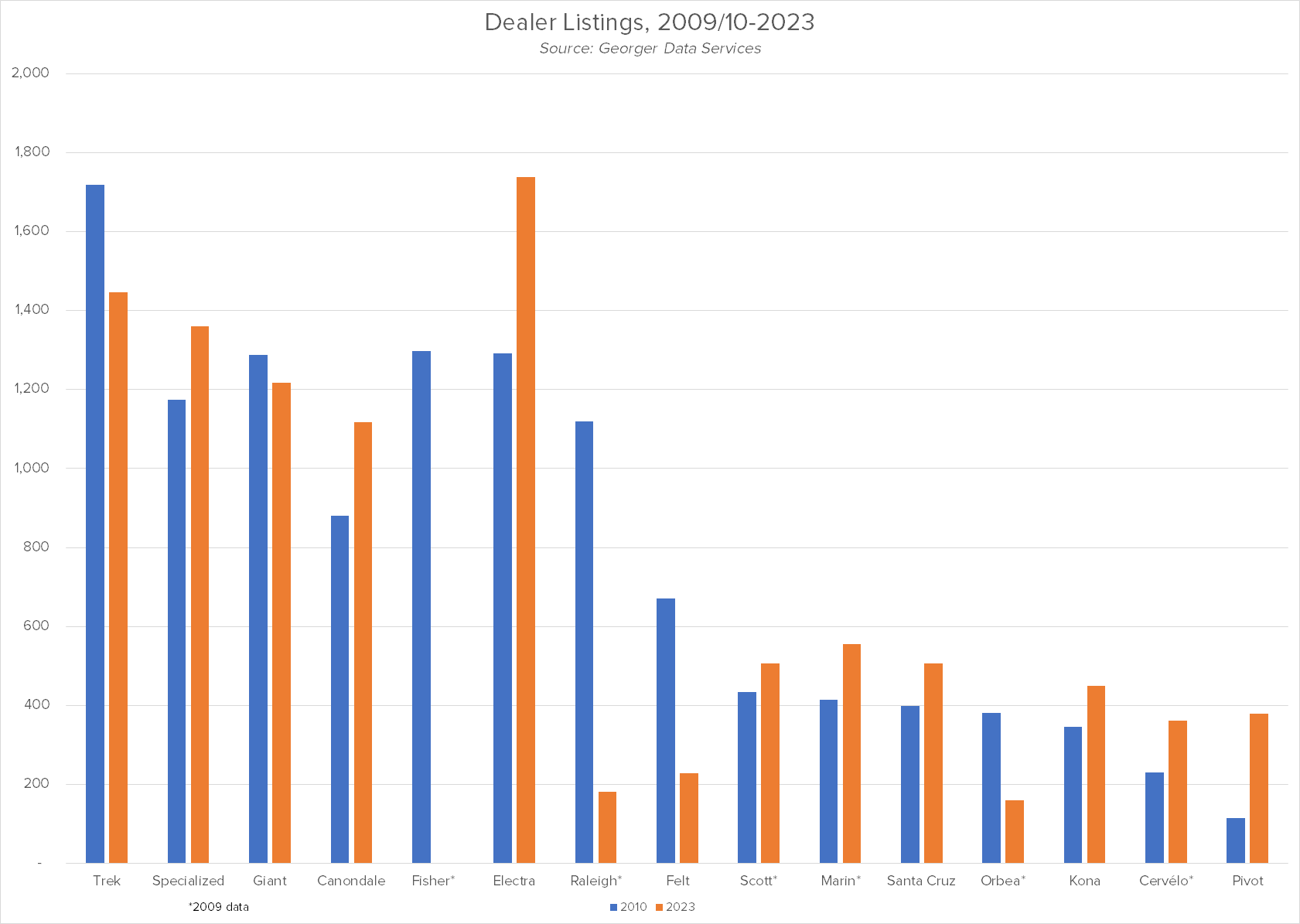

This time, Georger went to his archives to compare history: the first from 2009/2010 and a second showing dealer counts from October of 2023. This 13-year perspective tells us a lot about how the brands are doing, both over time and relative to each other.

The Big Four

It's a safe bet that all four brands' dealer footprint is well-established and essentially stable.

It's a safe bet that all four brands' dealer footprint is well-established and essentially stable.The most interesting thing about the top four brands (which I've chosen to call The Quadrumvirate) is how little they've changed in 13 years. In fact, Trek, Specialized, Giant and Cannondale (now part of the Pon group), in a slightly different order, were the top brands as early as 2000 if not before, based on my recollection.

But since 2010, there have been some subtle shifts in dealer footprint. Trek has trimmed its dealer base by 16%, from 1,718 in 2010 to 1,447 as of October of 2023. Specialized has added a similar percentage, 1,174 to 1,361, moving it from third place in the 2010 dealer count to its current ranking as #2. Giant dropped an insignificant 5% in thirteen years, from 1,287 to 1,118, slipping from second to third place among the Quadrumvirate as Specialized added dealers. And Cannondale has beefed up by the largest amount, 27%, from 881 to 1,118, a number which includes some 190 REI locations.

What we can't see from this data is how much churn (dealers leaving and being replaced for whatever reasons) is reflected in this change. But it's a safe bet that all four brands' dealer footprint is well-established and essentially stable. What's also not reflected here is one major change in retailer strategy — the move to distributor-owned stores on the part of Trek, Specialized and Cannondale/Pon, a development which further solidifies those companies' dealer bases, making them less volatile in key markets.

The Next Six (Other Popular Brands)

It's a two-way street: Make your brand more relevant and you attract more dealers. Attract more dealers and your brand's relevance to the market increases. Attract more dealers and your brand's relevance to the market increases.

If the Quadrumvirate's positions have been changing very slowly, the remaining six brands in the top 10 — the OPB — have been far more dynamic. Let's consider the fate of those brands from their 2009/2010 data.

First, two Trek-owned brands. Fisher, with 1,298 dealers in 2009, ceased to exist as Trek shut the brand down. Electra, with 1,291 dealers in 2010, (more than either Specialized or Giant at the time, but which Georger considers neither a Big Four brand nor an OPB), increased by 35% to 1,737 in 2023, making it now bigger than even Trek in terms of dealer storefronts. Its current dealer base includes 155 REI locations.

Raleigh's dealer footprint tumbled from 1,119 in 2009 to just 182 in 2023, an 84% loss of retailers as the company went through various phases of ownership. Felt dropped 441 dealers, from 670 to 229, a 66% loss. And Orbea declined 28% between 2009 and 2023, from 382 dealers to 159.

Now let's look at the OPB brands for 2023.

Scott increased its dealer base from 435 to 506, a modest increase of 16%. Marin grew by 34%, from 415 to 555. Santa Cruz climbed from 398 to 506 dealers, a net growth of 27%. Kona beefed up its dealer base by 30%, from 346 to 450. Cervélo added 131 dealers, taking it from 230 in 2009 to 361 this year, a robust 57% growth figure. And newcomer Pivot went through an impressive 230% increase, from 115 to 379 dealers.

If there's any lesson to be drawn here, it's that dealer base accurately reflects a brand's growing (or waning) relevance. It's a two-way street: Make your brand more relevant — whether through innovative product design, marketing, or other measures — and you attract more dealers. Attract more dealers and your brand's relevance to the market increases. But any way you look at it, dealers are key. Just ask the brands on the OPB list.