It's been a long, tough spring and now it's shaping up to be an even longer, tougher summer. Not only has the weather across most of the United States been terrible for business — unprecedented heatwaves plus massive rains, and even tornadoes and flooding, depending on what part of the country you're in — but consumer demand continues to be weak in many product categories, not just bicycles. As a result, bike industry sales are way down, and the massive inventories we carried into 2023 are still with us; if anything, the product oversupply has increased since spring. Although there are still shortages at some high-end price points, many of the bread-and-butter bikes we took on in Q4 of 2022 and the beginning of 2023 are still with us.

Dealers and suppliers alike have been stuck with huge numbers of bikes and the inventory doesn't seem to be going anywhere. Price reductions have not led to sales increases. To make matters worse, we're starting to see new 2024 models arriving with no place to put them. I keep hearing happy-talk stories about retailers or suppliers whose business is up versus pre-Covid levels, and congratulations to them, but for the majority of the companies at all points in the supply chain, these fortunate outliers seem to be the exception rather than the rule.

The numbers don't lie

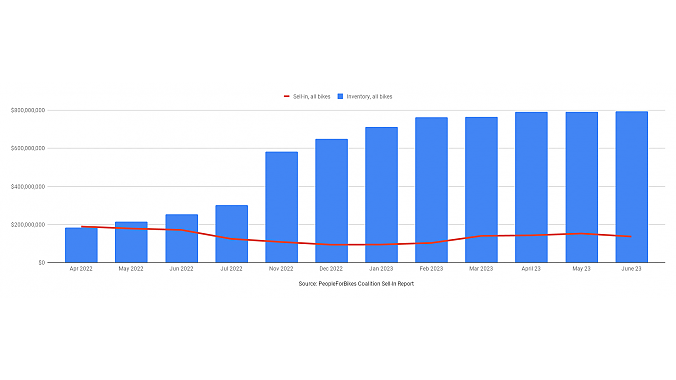

Here are the latest sell-in and retail inventory numbers from PeopleForBikes, which include e-bikes:

As you can see, there has been no seasonal reduction in the amount of product on retailers' floors. Inventory is just not selling through. According to PeopleForBikes' Senior Research Manager Patrick Hogan, inventory levels for June are at another all-time high.

At the same time, sell-in has been essentially flat since March, indicating there are few new bikes coming into retailers to replace models being sold, which means sales overall are not showing the kind of seasonal gains we would expect during the spring and summer months.

For lower- and mid-priced models which are already not selling through, the "new and improved for 2024" product simply doesn't have any place to go.

A look at recent BRAIN headlines helps puts some meat on the statistical bones. Sales for Giant-branded products in the first half of 2023 were down a jaw-dropping 44% in the U.S. Sales in Fox Factory's Specialty Sports Group — comprising its Fox, Marzocchi, RaceFace and Easton brands — were down 41% in the second quarter. The company said the decrease was "driven by higher levels of inventory across various channels." That's corporate-speak for "The shelves are already full and neither dealers nor consumers are buying."

As if low consumer demand, high inventories and fiscal distress weren't enough, suppliers are now bringing in 2024 model-year products. For higher-end bikes, this is not the catastrophe it might be; bikes in those price points remain hard to get and dealers aren't carrying huge supplies of them. But for lower- and mid-priced models which are already not selling through, the "new and improved for 2024" product simply doesn't have any place to go. Existing inventory has already been marked down since March and the product is still not moving ... although in many cases the markdowns merely restored prices to pre- "greedflation" levels.

Settling in for the long wait

Are we talking months of waiting? A year or more? Nobody knows, and anyone who claims otherwise is guessing.

So what should the industry do? Darned if I know. Another round of deeper discounts might be one way to stimulate store traffic, and there are promotional companies that specialize in moving distressed inventory, which is what bikes sitting in showrooms and warehouses have increasingly become. But at least part of the problem with discounts is that suppliers will want to apply them only when the dealer orders a replacement unit for the one sold to the consumer, which does nothing to ease the inventory burden on retailers.

A longer-term suggestion is to stop the forced obsolescence of products via model years. That will help correct the late-season discounting that's been plaguing us annually every year from 2009 through 2018 (2019 was an unusual year with record-low inventories carried over into the start of the pandemic).

But the truth is, there is no magic pixie dust that can be sprinkled on the bike industry to make it come back to life. We know that ridership numbers are up, so there are plenty of people interested in riding bicycles. We just don't know when they're going to start coming into retailers' stores and buying new ones. Are we talking months of waiting? A year or more? Nobody knows, and anyone who claims otherwise is guessing.

But eventually the pendulum will swing back and consumers will start buying bikes again. The real question is how many businesses, both supplier and retailer, will be able to keep their heads above water until it does. While larger companies (both supplier and retailer) have much greater resources, they may also have much greater exposure. In the end, it all comes down to how exposed they are (which is to say, how much additional inventory they're holding and getting), and what their bank relationships are like.

So, for now, we hunker down. All of us, at all points in the supply chain. And we wait. It's going to be a long, hot summer. And, in all likelihood, a long, cold fall and winter as well.