Bike companies don't publish their sales numbers. The closest we can get to their relative size is the number of dealers per brand, as measured by the same brands' own dealer locators. That's where data wizard Christopher Georger comes in.

Georger's company, Georger Data Services, specializes in collecting data from dealer locators in various industries and publishing the results for a group of clients, most (but not all) of whom are the same companies he's harvesting data from. "Everybody wants to know what everybody else is up to," Georger says.

GDS collects data from dealer locators, providing lists for clients and customers, Georger says, oftentimes merging company sales history with his list to create a dashboard for those companies. Georger also offers dealer lists through theBikeShopList.com.

In the bicycle business, that means gathering, updating and comparing dealer statistics from "about 50" bicycle brands that distribute through retailers in the U.S. (For a more in-depth look at Georger's methodology, see this 2019 article I wrote for the BRAIN website.)

For 2022, let's take a look at some general trends in the market and then dig a little deeper into the story behind the numbers.

The big picture

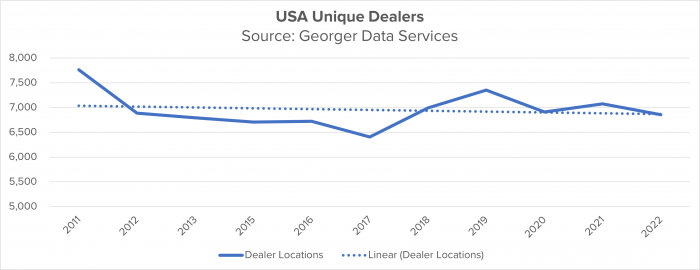

The single most remarkable thing about the dealer population over the last 12 years is how stable it is. The count hovers right around the seven thousand mark; as of March 2022, that number was 6,857, down just 219 dealers since 2021 and more important, only 56 dealers short of the count in 2020, the height of the COVID pandemic, when we heard stories of dealers forced out of business because they couldn't get enough product to keep their doors open. The total variation between 2020 and 2022 is less than 1%. That's a stable dealer population.

What's happening here speaks not so much to stability of the bike market itself as it does to low barriers to entry, one of the features of the industry's state of perfect competition. For sure, dealers go out of business — a couple of hundred a year or about 3% of the total dealer base, according to Georger — but they're quickly replaced by new retailers entering the industry.

As stated previously, GDS tracks about 50 bicycle brands and their dealer lists. Here's a chart showing the retailer location counts for the top 10 brands with the largest dealer populations:

The chart clearly shows the sharp drop off between the four leading brands — Trek (including Electra), Specialized, Giant and Cannondale — and other brands. But there's a long tail on those numbers that stretches far beyond the suppliers shown here.

At the end of the day, only slightly more than half (about 56%) of the total dealer population in the U.S. sells one or more of the Quadrumvirate brands. In terms of share of the dealer population, even Trek only has a presence in 20% of U.S. bike shops. Obviously, Trek's actual sales may be much higher, but in terms of retail locations, it's still only in one U.S. dealer out of five. Specialized is about the same, and we'll dig into those numbers a little more closely in the next section.

A subtle shift in the Quadrumvirate

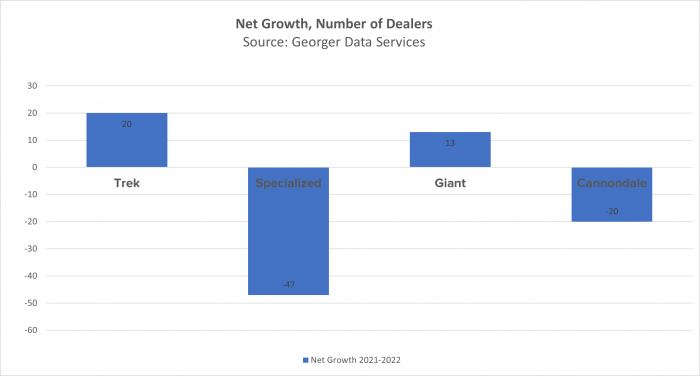

The big story here is that none of the top four brands experienced a huge shift in its dealer base. Net growth in terms of number of dealers is less than 4% for all four brands. But within those numbers, there's a lot happening.

Trek gained 92 new dealers over its 2021 total. But it also lost 72 dealers for a net gain of 20 and an overall dealer count of 1,379.

In terms of churn (the number of customers a brand loses over a period of time, in this case March 2021–March 2022), Trek ended up at just over 5%, which is about the same as its 2021 number. The brand also shows a net dealer growth of 1.5%, whether through dealer acquisition (buying shops) or recruitment.

In contrast, Specialized was far more volatile. It gained 218 new dealers but lost 265 for a net change of -47 versus the previous year for a total of 1,366 dealers. That gives it a churn rate of 19% and a net growth of dealers of minus 3.3%. Although the churn rate is high, Specialized was able to replace most of the dealers it lost. Which raises an interesting question: how many of those Specialized losses came from former Specialized dealers purchased by Trek? The data doesn't tell us the answer, but based on what we've been able to learn about Trek acquisitions in the past 12 months, they are doubtlessly a major contributing factor (see sidebar).

Giant gained 180 new dealers even as it lost 167 for a net gain of 13 and a final dealer count of 1,131. That gave them a churn rate of 15% and an overall net growth of 1.2%

Finally, Cannondale gained 170 dealers but lost 190 for a net loss of 20 and a churn rate of 17%. This reduces its total number of dealers by minus 1.8% and its dealer total to 1,105.

Here's how those net numbers look in graphical form:

It's important to remember that although the numbers may look large on the charts, they're only a relatively small portion of brands' total number of dealers. The big picture is that for all four Quadrumvirate members, the net dealer footprint is stable. And even as dealer acquisitions by Trek and Pon threaten to erode Specialized's position in the market, it is succeeding at finding alternative retailers.

At the end of the day, the most remarkable thing about the GDS dealer count is how little things have changed over the years. Those predicting doom and gloom or major players going out of business in response to pandemic-era supply chain pressures are simply wrong. But of course, what happens once the supply chain is full of product again is an entirely different question.

Sidebar

How many dealers has Trek purchased? According to GDS, in March 2021, the Trek dealer locator listed 198 dealers with the word Trek in their names. A year later, that number was 240. Trek is quick to say there are non-owned Trek dealers with Trek in their names and Trek-owned dealers without it, but it's difficult to escape the conclusion that Trek purchased something like 42 dealer locations that year ... an average of almost one per week. And that number doesn't include recent purchases where the name hasn't changed yet.

Since many of those purchases were shops that were formerly Specialized dealers, it seems unavoidable to conclude that Trek purchases of retail businesses hit Specialized's dealer numbers especially hard. Factor in the Mike's Bikes chain purchase of 12 former Specialized dealers by Pon in the fall, and it's easy to see why the brand incurred such heavy dealer losses in the past year which it had to scramble to make up.