Editor's note: A version of this article ran in the April edition of Bicycle Retailer & Industry News.

SANTA BARBARA, Calif. (BRAIN) — With the closure of Wisconsin’s Waterford Precision Cycles in 2023 and steady growth over the years, Stinner Frameworks has quietly become one of the highest-volume framemaker in the U.S., putting out just under 2,000 frames for its own brand and others last year.

And the 15-year-old company says it’s ready for more, with current capacity to make at least 3,000 frames a year in steel, aluminum or titanium, and room to grow. The company’s founder says Stinner can handle projects from design to bike assembly, including wheel assembly on a robotic Holland machine. Unlike some other small framemakers, Stinner is not just about welding hardtails and road bikes: It has the ability to design and manufacture full suspension bikes and other complicated projects.

CEO Aaron Stinner started as a high-end custom frame maker, but his company has grown to add a stock frame and complete bike program last year and has been steadily increasing its OEM (original equipment manufacturing) work in recent years. The company now makes bikes and other products for clients including Zink Bikes, Sklar Bikes, Rogue Fitness, Old Man Mountain Racks and others.

Stinner’s expansion into more OEM work comes as the Trump administration’s tariffs have some brands and consumers looking for domestic alternatives to China and other nations. But Stinner said the company has been moving in this direction for several years.

“We’ve always wanted to do it in the U.S., no matter who was in office,” Stinner told BRAIN in a recent interview.

“Our contract work has been quiet so far, and that allowed us to scale up at our own speed. We are at the point now where we can easily scale up. We know the levers that need to be pulled, we have the kinks worked out so I feel comfortable going out there and letting people know that we are doing this,” he said.

Stinner has about 10 employees at its 3,000-square-foot facility in Santa Barbara. The company has worked with area trade schools to find young workers with enthusiasm for manufacturing.

Stinner has about 10 employees at its 3,000-square-foot facility in Santa Barbara. The company has worked with area trade schools to find young workers with enthusiasm for manufacturing.

“We find people that are motivated to make stuff; we tell them that this is not like working at a bike shop. These are people who want to weld and to paint and learn,” Stinner said.

More than half the current staff is under 27, he said.

“There’s a good camaraderie among the employees. We are debunking the myth of what manufacturing is: It’s not a dark factory at the end of the road. We have robots and electronics and computers; we have big windows that let in natural daylight. It looks and feels a lot different from what people expect,” he said.

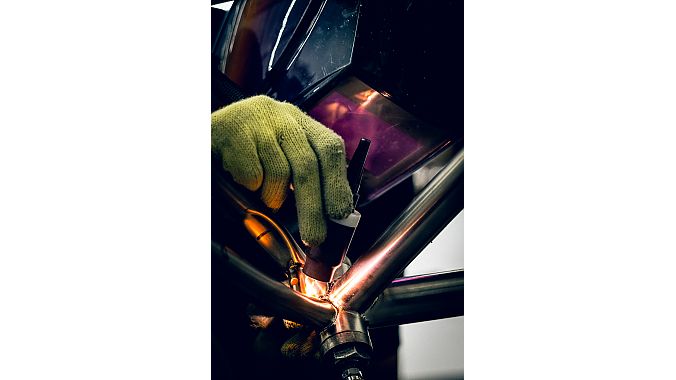

The factory has capabilities including robotic welding, CNC machining, laser cutting of tubes and sheet and metal forming. Finishing options include powder coating, wet paint, Cerakote ceramic finishing and titanium anodizing. Stinner said the company has largely been able to self-finance its growth over the years with assistance from its contract partners when necessary.

Stinner launched its Stinner Stock frame and bike program last year, offering several models of Stinner road, gravel and mountain bikes in stock sizes and configurations, ready-to-ship. The company has between 20-30 U.S. dealers and Stinner said the stock options let them offer a boutique U.S.-made bike at significantly lower prices than custom titanium options, for example. Complete bikes with steel frames start at $3,800 and complete titanium bikes start at $5,600. Like many small brands, Stinner will sell direct to customers who don’t live near a current dealer, but tries to connect the end-user with a local shop whenever possible.

As for contract manufacturing, Stinner said the company will accept minimum orders of 25 units. “The sweet spot for us is about 100 units,” he said. “Our goal is to compete with overseas manufacturing; we’re trying to show we can do it at scale here.”

“We’ve been expanding our capabilities over the past few years, emphasizing efficiency and quality,” he said in a recent press release. “While tariffs may influence global sourcing decisions for some companies, our greatest advantage has always been our capacity to adapt. We’ve narrowed the pricing gap with overseas production through automation and lean manufacturing, making U.S.-based manufacturing a competitive choice. We believe the future of mobility manufacturing should be here, and we’re demonstrating that it can be achieved at scale.”