By J.P. Partland

MEADOWLANDS, N.J. (BRAIN) — We asked retailers and suppliers at the CABDA East show this week about the “right-sizing” program that Trek has planned, and what it will mean to the rest of the industry.

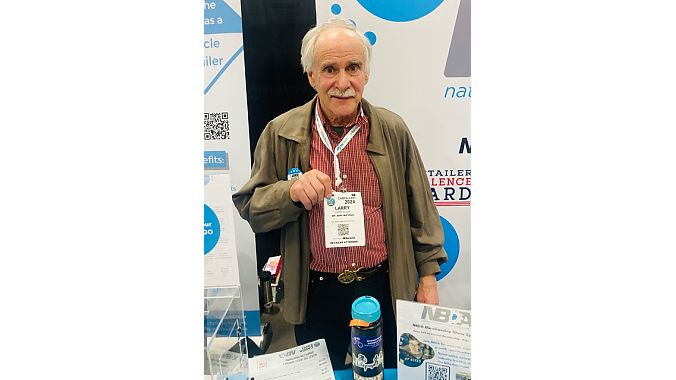

Larry Black, Mount Airy Bicycle, Mount Airy, Maryland (a current Trek dealer):

“I heard they're planning to cut 40% of their SKUs and I think that's a great idea. Most people should. They should make the catalog half the size if not smaller, and don't have models every $60. This has been a big obstacle since I started selling Trek in the late 70s. This has been a serious obstacle: too many models too many colors …

“As far as the 10% cut, whatever that means — workforce maybe, cutting jobs? Yeah, I think too many of these companies, based on my experience, are trying to grow artificially. They are trying to grow horizontally instead of vertically. I’d rather see vertical growth, which means more integrity, better service. Fewer but better.

“Trek has been trying to do too many things. Now they are trying the Red Barn thing, which is used bikes. I know more about used bikes than they do because I’ve got 5,000 of them. But that’s just another complication and I think some of that might take advantage of consumers in the wrong way. The downside is some of the consumers who might think they need the variety don’t really need the variety. And I can tell you from experience: I think right sizing is one of the smartest things anybody can do, not just Trek.”

Marc Cianfrone, Pop’s Bicycle Shop, Somerville, New Jersey (a Trek dealer):

"I think that they're finally doing the right thing.  It probably should've been done significantly prior to this, but the fact that they're finally recognizing some of the issues that we're running up against, not just Trek dealers but the industry as well, it’s about time. It will probably create a little bit more turmoil, but if it works out well, it could give a roadmap to other suppliers to go in the same direction.”

It probably should've been done significantly prior to this, but the fact that they're finally recognizing some of the issues that we're running up against, not just Trek dealers but the industry as well, it’s about time. It will probably create a little bit more turmoil, but if it works out well, it could give a roadmap to other suppliers to go in the same direction.”

Benita Warns, co-owner of Midway Bicycle Supply and Mr. Michael Recycles Bicycles, St. Paul, Minnesota:

"I'm not surprised, not in the least. I’m based in St. Paul, that's the part of the world where the largest bicycle parts supply company is based and they within the last couple months have laid off people and they’ve canceled orders on parts that they were going to stock. So it doesn't surprise me at all that a company like Trek or any other major bike company would end up cutting back, laying off, and downsizing. Pretty much across the industry we are down.  We are one of the rare places that actually held our own last year.

We are one of the rare places that actually held our own last year.

"For shops, obviously if there's a little less product around they won't have as many things to choose from, but on the other hand that could be a positive because then shops will get a little more freedom to be able to operate without having to having to buy everything from Trek and not be allowed to buy from anybody else. That's very, very restrictive, almost to the point of being protectionist — who owns the shop? The shop is supposed to be owned by the owner of the shop, not their supplier."

Amos Brumble, owner of Brumble Bikes in Westerly, Rhode Island:

“I think it's probably the right move; it’s going to be painful for everybody and I hope it leads to a better business model in the future and gets them away from … trying to cover all the bases, which I think the bike market doesn't support. There's going to be some dealers that are going to depend on certain SKUs that are going to get cut and it’s going to affect them. They may have to fill that in with a different product line and that can be hard.”

Peter Henry, former owner and current board member of Landry’s Bicycles in Massachusetts (a Trek dealer. No photo available):

“Specifically on reducing the number of SKUs they are about 30 years overdue to make that move. They would make more money, and their retailers would make more money, if they streamlined their product offering and had less confusion and fewer SKUs and fewer inventory problems. So I think it's a really smart move on their part and I don't know why they're finally doing it now, probably for the wrong reason, but what whatever the reason, we will take it."

(For shops) "If the right sizing means that they're going to reduce service levels to retailers, that’s a problem. I mean, if their sales are not adequate to make their numbers, to support the payroll level that they have, obviously they need to deal with that. If they went out of business, it would be far worse for retailers. So you have to do what you have to do. But the reducing the number of SKUs for bikes is just plain positive and long overdue and I wish that some of the other suppliers would do the same."

Phil Cohen, Chain Reaction Bicycles, Evans, Georgia:

"Well in these times where everybody is struggling no one is immune to those sorts of factors. I just see it as a company trying to do what they think is best for their business.”

(Could it be a negative for retailers?) “If a company doesn't offer the support the dealers need, that could be a negative effect, but there's a lot of turmoil in our industry right now and I know it's probably gonna be a year or more before things settle out. It’s gonna be a rough ride until then and nobody’s immune.”

Shane Hall, Bicycles NYC:

“It’s not surprising. Coming out of the pandemic most companies have had a lot of product still sitting in warehouses, a lot of companies have overproduced in the last year or so, so they’ve had to put bikes on sale.  So I can imagine the need to cut costs and cut spending. Since the end of the pandemic we’ve seen the used bike market has exploded from people who stopped riding, so that’s put a little bit of a damper on new bikes sales as well.

So I can imagine the need to cut costs and cut spending. Since the end of the pandemic we’ve seen the used bike market has exploded from people who stopped riding, so that’s put a little bit of a damper on new bikes sales as well.

“I think the challenge for us is finding what is the new normal. This is something we’ve been talking about for a while now: We knew what the pre-pandemic normal was and we kind of settled into that. During the pandemic sales went through the roof and so now the question is where are we now? Where is the new normal of what do you buy, what do you forecast, how much product do you keep in stock? How much product do the vendors actually buy for the season? We have to figure that out now."

"I haven’t seen any cuts from other suppliers yet, I have seen bike sales prices dropping and looking at other industries you’ve seen cuts at large companies, so this isn’t surprising."