By Jay Townley

McKinsey reported in its September Quarterly Report: "More than 15 million US workers – and counting – have quit their jobs since April 2021, a record pace disrupting businesses everywhere. Companies are struggling to address the problem, and many will continue to struggle for one simple reason: they don't really understand why their employees are leaving in the first place."

This report adds to the speculative mystery about the U.S. economic recovery The Washington Post reported on Sept. 4 when it asked why there are "10 million job openings, yet more than 8.4 million unemployed are still actively looking for work."

The Post article went on to state that the U.S. employment crisis hit "an inflection point" the weekend of Sept. 4-5, "... as many of the unemployed lose $300 in federal weekly benefits and millions of gig workers and self-employed lose unemployment aid entirely."

While some observers predicted a surge in people seeking employment, others pointed out that in the 22 states that had already stopped or phased out the $300 weekly benefits, applicants for jobs did not jump up. We will have to wait to see how this plays out, but it appears the economy and labor market are going through a major shift and according to Ben Bernanke, Federal Reserve chair from 2006 to 2014: "We are reallocating where we want to work and how we want to work. People are trying to figure out what their best options are and where they want to be."

A reallocation, also referred to as a great reassessment of work in America by The Washington Post, points to a fundamental mismatch between what businesses and industries have the most jobs available and unfilled as we enter the last quarter of this year, and how many unemployed people used to work in those businesses and industries pre-pandemic.

As an example, in early September 2021 there were 1.8 million job openings in professional and business services, compared to 925,000 people employed in this sector pre-pandemic. Retail and wholesale trade also are reported to have more openings than prior workers.

Add to this mismatch the workers who used to work in these businesses and industries who have indicated they do not want to return, and those who are thinking of quitting.

This is a massive reassessment of work from both the employer and employee standpoint. Employees have changed how they want to work — and where they want to work. The pandemic with its lockdowns, stay-at-home orders and uncertainty changed people!

Some people want to work remotely for the rest of their lives. Individuals and families have changed where they live and how they live so they can spend more time with each other, relatives, and friends. Other folks want a more flexible or more meaningful career path. It is about quality of life, mortality, and the you-only-have-one-life-to-live mentality.

At the same time, employers have increased deployment and use of artificial intelligence and automation while changing office space and entire supply chains requiring new and different skill sets, and in some cases, fewer workers.

As this pandemic-induced reassessment took hold during 2020 it spread to all facets of the labor force and labor market by 2021, as people started to make vastly different decisions about work.

Resignations are the highest on record, as noted, representing a 13% increase over pre-pandemic levels, disrupting businesses throughout the country.

There has been a surge in retirements with 3.6 million people retiring during the pandemic, or more than 2 million more than expected.

There are 4.9 million more people who are not working or looking for work than there were before the pandemic.

What are these people, these former workers, doing? Part of the answer is the boost in entrepreneurship that has caused a significant increase in new businesses!

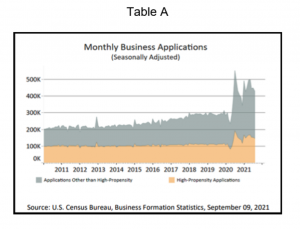

2020 saw more business applications filed than any year on record, up 24% from 2019. The U.S. Census Bureau recently released data on this trend—between December 2020 and January 2021, business applications increased by 42.6%. We are investigating how we can find out how many of these new start-ups are in the bicycle and e-bike businesses.

Nearly half of those applications came from businesses that are highly likely to create jobs and employ people. According to the Economic Innovation Group, these are the businesses "most likely to lead to lasting job growth." The uptick is in stark contrast to previous recessions. According to the EIG, there were 230,000 fewer likely-employer business applications in 2008 than in 2007.

The following table A shows Monthly Business Applications from 2011 through August 2021. The sharp decline in early 2020, as the pandemic impacted the economy is reversed, followed by a dramatic increase during the last half of the year – the 42.6 percent increase, followed by a decline in the winter, followed by a sustained increase from the first quarter through the middle of this year, well above all previous years.

The pandemic has changed Americans through fear, frustration, anxiety, sadness, joy, exuberance, discovery, wonderment - through the lows, the highs – with the result that there is a mismatch, an asymmetric relationship between workers and jobs!

America does not have a labor shortage. It has a big and growing portion of its labor force that simply does not want to continue to do what bosses want and expect workers to do. We have what Strother Martin called "...a failure to communicate" in Cool Hand Luke.

Some people, mostly women, are hesitant to return to work until they are fully vaccinated, and their children are back in school and in daycare full time. A lot of people want to do something different with their lives than they did before the pandemic and are genuinely excited about the prospect of a different way of living their lives.

Let us go back to the 15 million American workers who have quit their jobs since April 2021. According to the research McKinsey conducted, companies are struggling to address this problem — because they have not taken the time to truly understand the real causes of this attrition.

Employers jump to conclusions and quick fixes like bumping up pay or other financial benefits — without making any effort to strengthen relational ties with their employees. The result is, according to McKinsey, rather than sensing appreciation, employees sense a transaction, and a transactional relationship reminds them that their real needs are not being met!

How does this impact the American bicycle business? I had an email exchange with Laurel King, the principal in Outdoor Industry Jobs in early September and she told me that "... starting last January our count of posted jobs has been high. Last month was our largest ever."

Relative to the bicycle business, Laurel also told me: "The bicycle sector particularly has be[en] growing because of Covid and bike shops were deemed essential."

Like every other business in America, bike shops, suppliers and brands are advertising for and making every effort to keep employees.

McKinsey Quarterly for September 2021 reports that according to their recent survey, "... employees crave investment in the human aspects of work. Employees are tired, and many are grieving. They want a renewed and revised sense of purpose in their work. They want social and interpersonal connections with their colleagues and managers. They want to feel a sense of shared identity."

The survey shows that employees also "... want pay, benefits, and perks, but more than that they want to feel valued by their organizations and managers."

One of the cautions flagged by McKinsey is that owners, executives, and managers that think that employee attrition is easing — or is limited to particular businesses like hospitality and restaurants are misguided. "Forty percent of the employees in our survey said they are at least somewhat likely to quit in the next three to six months. Eighteen percent of the respondents said their intentions range from likely to almost certain."

Furthermore, McKinsey reports that "... these trends may persist. 53% of the employers said that they are experiencing greater voluntary turnover than they had in previous years, and 64% expected the problem to continue – or worsen – over the next six months."

Among the employees in the McKinsey survey, a significant "36% who had quit in the past six months did so without having a new job in hand."

This illustrates one of the important ways the current reassessment of work differs from previous downturn-and-recovery cycles – and another sign that employers may be out of touch with just how hard the past year and a half of pandemic have been for their workers.

McKinsey warns that this "... trend is not only poised to continue but could get much worse. Among employees who said they are at least somewhat likely to leave their jobs in the next three to six months, almost two-thirds added that they would do so without lining up new jobs."

Bike shop owners, HR managers, supplier and brand executives and CEO's must understand why employees are leaving or they risk even higher rates of attrition. The McKinsey survey shows that when employers were asked why their people had quit, "... they cited compensation, work-life balance, and poor physical and emotional health."

While these issues mattered to the employees that quit, they just did not matter as much as their former employers thought they did.

McKinsey found that: "... the top three factors' employees cited as reasons for quitting were that they didn't feel valued by their managers (54%) or their organizations (52%) or because they didn't feel a sense of belonging at work (51%)."

The American bicycle business, from top to bottom, is a white male-dominated business. McKinsey found that employees who classified themselves as non-white or multiracial were more likely than their white counterparts to say they had left because they did not feel they belonged at their companies.

This, as McKinsey reports, is "... a worrying reminder if the inequities facing Black employees and other minority groups." I would add that the lack of female employees in the bicycle business adds gender to this concern going forward.

In addition to becoming much more diversified and welcoming by educating, training, and employing people of all races and genders, the bicycle business and bike shops need to provide answers for employees that want career paths and professional development opportunities.

This is easier for suppliers and larger bike shops and multi-store specialty bicycle retail chains but is still dependent on adopting diversification in hiring and employment policies and procedures that become part of the businesses culture.

For specialty retailers It also means reaching out and networking with other bike shops, suppliers, and brands to establish career paths and opportunities both for employees and for recruiting and hiring. This also is part of building a sense of community within the business that extends beyond the bike shop and its locations. Members of the National Bicycle Dealers Association should investigate the networking benefits of both the association and its P2 Groups

Admittedly creating career paths and employment opportunities can be harder for midsize and smaller bike shops – but it is not impossible, particularly when the business becomes a member of the NBDA, which is a national network that includes suppliers and brands as associate members.

If you are the leader of a large supplier or multi-store chain – or the owner of an up-and-coming neighborhood e-bike shop ... remember the great reassessment of work is real, is going to continue, and may get worse before it gets better. However, this is also an opportunity for your business, large or small, to listen, learn and make the changes your employees want – starting with sharing the relational and human aspects of appreciation and not just the necessary transactional stuff.

Jay Townley is a co-founder of and Resident Futurist for Human Powered Solutions, a unique consultancy consisting of some of the most experienced and knowledgeable people in the Micromobility space – www.humanpoweredsolutions.com.