"May you live in interesting times." Perhaps the most remarkable thing about this alleged Chinese blessing/curse is that it's completely apocryphal; there is no equivalent expression in any Chinese dialect. And yet here we are, living in times that are not merely interesting, but literally unprecedented.

2020 is less than three-quarters over, and it's already shaking out as the wildest roller coaster ride in industry memory. Popular wisdom is that current inventory woes began when COVID-based factory closures combined with COVID-based lockdowns that stimulated families worldwide to rediscover cycling. Together, they created a perfect storm: exploding interest in bike riding accompanied by an unprecedented shortage of bikes to be ridden.

But as usual, popular wisdom leaves out several of the most important — and, for our purposes, most interesting — parts of the story.

Will 2020-style demand for bikes continue into 2021? Nobody knows, and anyone who claims otherwise does so at their peril.

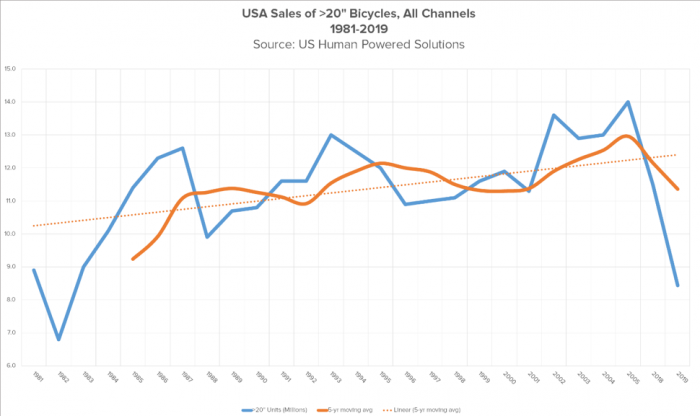

The first thing people tend to forget is that 2019 was the worst year in almost four decades for U.S. bicycle imports. As I pointed out back in April, supplier inventories coming into 2020 (with the exception of e-bikes, where non-IBD brands in particular bet heavy and reaped the benefits) were at an all-time low. The months-long factory shutdowns that crippled the supply chain this year merely exacerbated an already existing product shortage. To be clear, the scene was already set for a product supply debacle long before the COVID-19 virus began shuttering factories.

The second element missing from the bike shortage equation was the expiration of tariff exclusions on many Chinese-made bike categories in early August. Although covered in detail here in BRAIN, the larger industry conversation seems to have missed the fact that road bikes (MTBs have been subject to the tariff since last year) now cost 25% more to import than they did in July; other important categories (lights and helmets) have already expired, and exclusions on e-bikes are scheduled to lapse Sept. 20. There is no expectation the e-bike tariff suspension will be renewed.

Offsetting the tariffs has been the scramble to relocate production to new factories in Vietnam, Cambodia and other Southeast Asian countries. There is nothing new to this; Europeans have been exiting Chinese factories literally for decades in response to the EU's anti-dumping duties against Chinese bicycles and e-bikes. Nonetheless, as of this writing, fully 88% of U.S. bicycle imports are still coming from China. As with the EU, it's going to take us a lot of years to turn that boat around.

Last, and perhaps most important in the long run, it's inevitable that demand for bikes in 2020 will wind down eventually. This is, after all, a seasonal business. Regardless of what can be done to mitigate the tariff-induced price hit on road bike imports, it's clear that no one — neither suppliers nor retailers — wants to be sitting on warehouses full of higher-cost inventory coming into an uncertain 2021 season.

Not that that's likely in any case. According to Specialized executive vice president Bob Margevicius, we can expect another 12–18 months of product shortages before the supply chain can provide on-demand availability of bicycles.

"There were 82,000 bikes (23,000 e-bikes and 62,000 traditional bikes) on hand on August 1 of this year," he told me. "Last year, same time, there were 597,000 on hand (31,000 e-bikes and 566,000 traditional)." That's an 86% year-over-year inventory drop versus 2019, which remember, already had the lowest inventory levels on record.

But supply is one thing and demand is another. Will 2020-style demand for bikes continue into 2021? As I said, nobody knows, and anyone who claims otherwise does so at their peril.

What suppliers want

We've already covered what suppliers don't want — expensive inventory sitting in their warehouses. Conversely, what they do want, is as much inventory as possible sitting in retailers' stores.

One of the hallmarks of Bike 3.0 is what I've labeled Invendentured Servitude: locking competing brands out of dealers' showrooms by flooding participating retailers with huge inventory requirements under preseason contracts. For 2021 preseason, they've already ratcheted up the demands. "If you want any inventory at all next year," they say, "you'd better step up now with firm, noncancelable orders for the entire season."

“If you want any inventory at all next year,” they say, “you’d better step up now with firm, noncancelable orders for the entire season.”

That "noncancelable" part works in a couple ways. First, it protects the supplier from what we've already seen this year: retailers over-booking tons of bikes in hopes of actually getting a fraction of what they've ordered. To the extent that that's happening, noncancelable orders (or those backed with cancellation fees) are a completely reasonable supplier precaution.

But noncancelable orders also advance another agenda: that of preventing retailers from going to alternate brands and forging parallel supply lines that compete with their existing vendors.

Which, it turns out, is exactly what they're doing.

What retailers want

Among the four industry players that make up The Quadrumvirate, the general Bike 3.0 strategy might best be expressed by this quote, attributed to Trek president John Burke: "Put all your eggs in one basket. Then watch that basket like a hawk."

Say it that way and it almost sounds reasonable. But what happens when the egg supply fails, as it has done for months, is doing right now, and is likely to continue doing all the way into 2022, as Margevicius predicts? Ironically, it's the most loyal retailers who are punished the worst by The Quadrumvirate's single-basket strategy.

At the end of the day, the most important thing retailers need is a reliable supply of sellable product, regardless of brand. All other considerations are secondary.

At the end of the day, the most important thing retailers need is a reliable supply of sellable product, regardless of brand. All other considerations are secondary.

This reliable supply has been missing in 2020, and guess what: dealers have absolutely no appetite for repeating that experience in 2021 or beyond. Increasingly, they are turning to alternative brands as insurance against repeated product shortages. Which is very good news for non-Quadrumvirate brands, especially those who offer smaller buy-in quantities and more flexible inventory planning and management options.

The majority of retailers I've spoken with are already looking to bring new brands into their businesses for 2021. Rather than a single dominant bike line with a few outliers sprinkled in for filler, the emerging strategy seems to be creating a healthy ecosystem of competing quality brands under one roof. And if that model sounds familiar, that's because it's exactly what the approximately 30% of retailers who are not aligned with a Quadrumvirate brand have been doing for years. It's way too early to call that Bike 4.0, but it does give a glimpse of one possible future for the next phase of the industry.

Make no mistake, Quad brands will always enjoy pride of place in their dealers' showrooms. But starting right now, they'll be sharing more of that crucial floor space with competitors, and they'll be doing it for the foreseeable future.

Rick Vosper has been helping companies in the bicycle business solve marketing problems since 1989. Email rick@rvms.com for a free consultation.