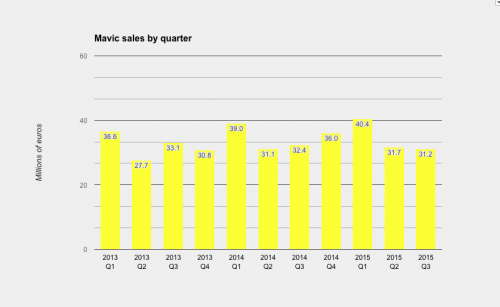

HELSINKI (BRAIN) — Sales in Amer Sports Corp.'s cycling business — via its Mavic brand — were down 5 percent in its third quarter, which ended Sept. 30, and up 1 percent year to date compared with the same period last year.

The cycling category contributed 31.2 million euros ($35 million) in the quarter, down from 32.4 million euros last year. Year to date, cycling sales were 103.3 million euros, up from 102.5 million in 2014. All the figures are in local currencies.

Overall, Amer's sales were up 5 percent in the quarter, to 713.7 million euros; year to date, Amer's sales were 1.75 billion euros, a 6 percent increase.

Besides Mavic, Amer owns brands including Salomon, Wilson, Atomic, Arc'teryx, Suunto and Precor. This year, it bought the baseball brand Louisville Slugger; Spinner, an indoor cycling company; and Queenax, a functional training brand. Amer is counting the Spinner business in its "fitness" business category, while Mavic/cycling is put in its "outdoor" category.

In an earnings statement, the company attributed the quarterly decline in cycling sales to the delay in delivery of a "key product" until 2016. In a conference call with investors on Thursday, Amer president and CEO Heikki Takala said the key product was a wheel. "We needed to delay a key product — a wheel — until 2016. It's nothing dramatic, just a delay," he said.

Mavic did not give any other details about Mavic's business in its earnings statement or on the phone call. Mavic sales were up 3 percent in the first half of this year.

"We continued to grow profitably in the third quarter, driven again by footwear, apparel, business-to-consumer (sales) and China (sales)," Takala said in a statement.

"Also ball sports delivered strong profitable growth behind healthier fundamentals following ball sports' new strategy. Importantly, our quarterly cadence in 2015 is quite different compared to 2014, with footwear and apparel deliveries peaking in the third quarter in 2015, and winter sports equipment and sports instruments peaking in the fourth quarter. In fitness we continued to focus on profitability whilst preparing for acceleration in 2016 with important new building blocks. For example, Queenax functional training acquisition and our Spinner licensing deal."