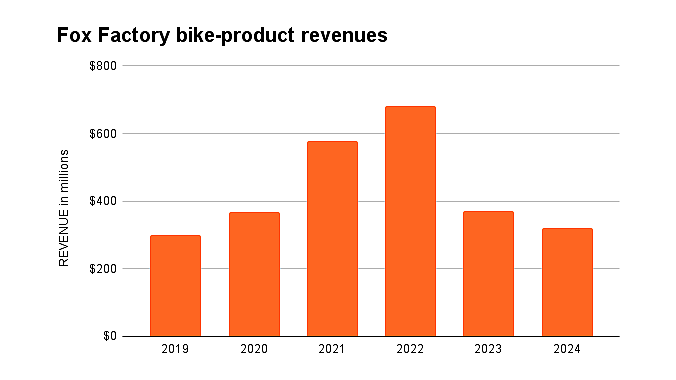

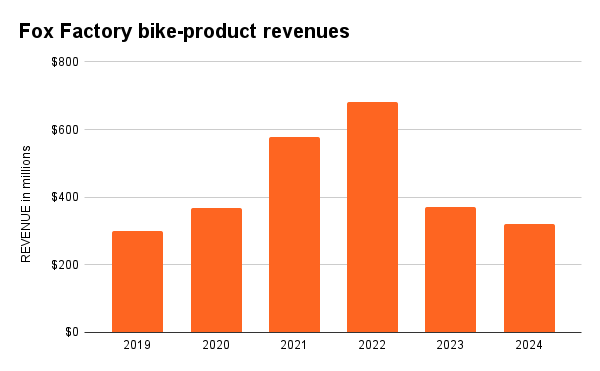

DULUTH, Ga. (BRAIN) — Continued inventory “recalibrations” in the global industry and uncertainty about consumer and bike-maker demand has Fox Factory executives cautiously forecasting flat sales in its bike-product segment this year.

“We think there could be upside in the bike business this year, but keep in mind we’ve had a couple of really challenging years forecasting in that business, so we’re conservative right now,” Fox Factory CEO Mike Dennison said in a call with analysts Thursday.

“What we've seen so far in Q1 are pretty positive signals,” Dennison continued, regarding the bike business. “We think inventory is better in control. That's a great sign. We think our product launches and our product diversification in that space is good,” he said.

Fox Factory’s bike-product sales finished 2024 on the upswing, with a 8.3% increase in revenue in the fourth quarter. For the full-year, however, its bike business was down 14% from 2023 due to continued inventory adjustments and cautious buying.

“Bike dealers, distributors, and OEMs are all very resistant to inventory positions,” Dennison said. He said that resistance dampened purchasing in late 2024, but left the industry flexibility to react to unexpected demand later in the year.

“In general, the bike industry is significantly healthier coming out of ’24 than coming out of ’23 … There's going to be a good build this year as new products really start to get launched.

“Remember, the industry really hasn't seen a lot of new products in the last several years because people are trying to burn through inventory that could have been two, three years old. So this is the first chance to bring some real fresh new innovative products to the market.”

While some of those market demands are out of Fox’s control, the company said it continues to reduce costs in its bike business by streamlining and consolidating its factory in Taiwan. With that process largely completed, Dennison said the factory there should have ample capacity for several years and any further expansion in Asia will likely happen “off the island” of Taiwan, in Vietnam, Thailand or elsewhere in Southeast Asia.

Full company results

Fox’s net sales for the year were $1.39 billion, a decrease of 4.8% compared to fiscal 2023. Most of the decrease came in Fox’s Aftermarket Applications Group and its Powered Vehicle Group. The Speciality Sports Group, which once was 100% bike products, has diversified with the inclusion of the Marucci baseball/softball brand in 2023. Thanks to the inclusion of Marucci sales, the SSG business segment grew 31% last year.

Fox’s bike business is conducted through the Fox and Marzocchi suspension brands, the RaceFace and Easton component brands and the Ride Concepts shoe brand. Fox also does bike business with its Lizard Skins and Ouray grips and handlebar tape, which are part of Marucci.

Company-wide net income was $6.6 million, compared to $120.8 million in the prior fiscal year. Earnings per diluted share for fiscal year 2024 was $0.16, compared to $2.85 in the same period of fiscal 2023. Adjusted EBITDA decreased to $167.0 million in fiscal year 2024, compared to $261.0 million in fiscal year 2023.

Tariffs

Most of Fox’s bike business is in Taiwan so it should have little direct exposure to new U.S. tariffs on Chinese goods and aluminum and steel imports, the company said.

Dennison allowed, however, that new tariffs on complete bikes with Fox components could raise costs and reduce demand. “The impact (of tariffs) on the U.S. bike industry is yet to be fully understood by our OEM customers,” he said.

2025 guidance

The company said for the full fiscal 2025 it expects net sales of $1.385 to $1.485 billion (compared to $1.39 billion in 2024), and adjusted earnings per diluted share in the range of $1.60 to $2.60 (compared to $0.16 diluted EPS in 2024).

Fox CFO Dennis Schemm said Fox expects “a gradually stabilizing environment” in its powered vehicle and bicycle divisions, with sales roughly the same as 2024 but increased earnings and margins due to a continued cost-savings program.