A version of this feature ran in the August issue of BRAIN.

BOULDER, Colo. (BRAIN) — For our August magazine edition, we asked our State of Retail panel members: How are you approaching your 2025 ordering? What, if anything, is different this year?

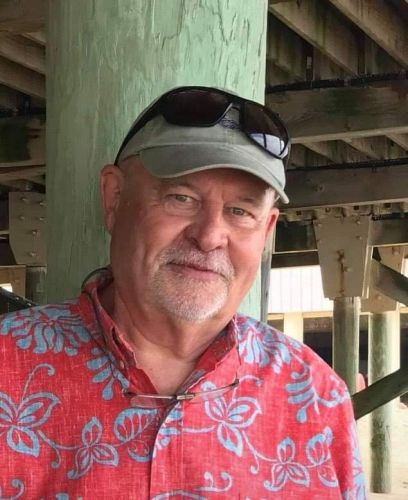

CARSON CITY, Nev: Win Allen, owner Win’s Wheels

Our service-only business model will be staying the same in 2025, and we will not be selling any bikes, frames, shoes, helmets, gloves, etc. We provide service, parts, accessories, and nutrition, so we are always looking for the current trendy items in those categories. We haven't seen any new pre-book programs for 2025 in these categories as of yet. We never go deep because we want to be able to change with the trends and not have to sell, blow out, or discount before we can bring in the latest trendy item. This helps keep our inventory dynamic and prevents us from overbuying. Also, we intentionally run our inventory down in the off-season. If we need an item in winter, we order the bare minimum amount to service a client. This also helps with cash flow to be able to add new items to our inventory, instead of waiting to sell through the previous generation. During the summer, we usually order multiples of items to help get free shipping and/or quantity discounts and minimize the need to order frequently.

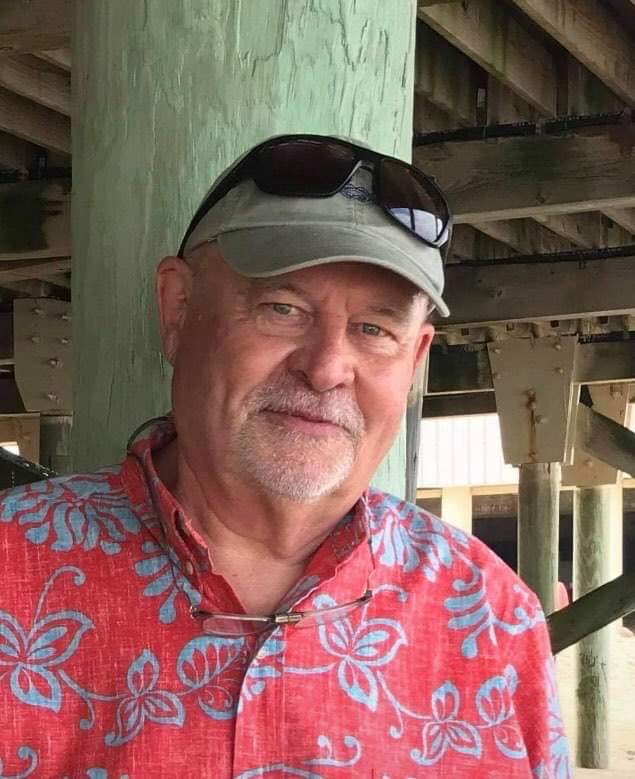

ENCINITAS, Calif.: Steve Yeager, owner Cadence Cyclery

We are approaching our 2025 buying similarly to previous years. The biggest change for us will be to offer more in the MTB category. We will end the year with too many entry level bikes, but otherwise, we have the right amount of inventory for the rest of 2024. Pre-book programs are still at play, but it seems like the ball is in the court of the retailer. Suppliers are much more flexible and open to adjusting programs to fit the retailers’ needs. I feel this is the way it should be. Cookie-cutter programs don’t work for all markets.

CHAGRIN FALLS, Ohio: Jacob English, owner Mountain Road Cycles

We will end this year with just about the proper inventory for demand. We have scaled back a bit. However, just-in-time only works if suppliers have the correct inventory in stock when you want it. We are approaching our 2025 purchasing carefully but trying to keep all key categories in stock. Clients are still buying shoes, helmets, and gloves, as they can try them on. Clothing is another matter, as they are used to buying online with easy returns. We try to keep our bicycle inventory light, ordering what’s available on any given day or month. We would like more kids’ bikes, please! We will work with pre-book programs that offer advantages to our business like favorable terms and dating. I would say that ordering has been very different the last year and a half with more lenient policies but less forgiving accounts payable policies.

CHICAGO: Gillian Forsyth, owner BFF Bikes

As a small store, I stay true to the brands and reps that help me manage the store and its inventory. I know who cares and who doesn’t. For 2025, I am looking at my 2024 sales volume and ordering probably a bit less than I ordered last year to be cautious, as long as I can make terms and earn discount levels. If I know for sure I will sell X number of helmets, I’ll fill in what I need to end the year then choose the last delivery window for the rest. I’m in Chicago, so I don’t need extra inventory for the early season.

I haven't looked at all of the 2025 programs yet, but I think the buy-in levels seem a bit lower than in the past, which is nice for us smaller stores. I’ll try not to get caught up in the hype of a 6% discount on $2,500 of product — the $150 isn’t worth it. I would like to say that the fact that our vendors are requiring us to fill in 2025 orders NOW is ludicrous. I don't think my forecasting is any better than theirs; in fact, they have better insight into sales because they have the luxury of seeing what has sold in multiple stores. I just have mine, so it is a complete crap shoot.

NEWINGTON, N.H.: Steve Gerhartz, owner Seacoast E-Bikes

The biggest issue for us is the lack of transparency regarding product availability, which causes us to overstock. In 2025, we are looking to decrease all inventory and be more data-driven in our purchasing process. We will end 2024 with too much inventory, partly caused by the manufacturers' lack of transparency about what's in the pipeline. Some suppliers are offering pre-book discounts on overstock and longer terms, which I believe can have the opposite effect of what is intended. If I am offered bikes and told I have eight months to pay, my brain tells me "that's plenty of time to sell them," but in my experience this can be a costly mistake. There is no way to see what new products are coming or what the prices will be. In the past, I ended up selling bikes at or below my cost because the manufacturers dropped the prices before my payments were due.

WINTHROP, Wash.: Julie Muyllaert, co-owner Methow Cycle & Sport

We’re approaching ordering for 2025 cautiously. Not so much in terms of increases and decreases in inventory levels, but more in terms of booking bike preseason orders. Overall, we’re happy with our inventory levels and have transitioned well from stocking up during the pandemic years to maintaining leaner inventory and getting back to three to four turns. Staples such as helmets, pumps, tires, tubes, gloves, and shop-branded apparel continue to sell well. And sales of MTB, gravel, electric and kids’ bikes are steady. What concerns us is that there still appears to be a fair amount of uncertainty in the industry with respect to pricing and promotions. We were thoughtful with our 2024 bicycle pre-books, but saw our margins erode with unplanned and extended promotions. A couple of our brands offered credits to make us whole, but we lost significant margins on some makes and models. Intentional or not, some brands rewarded dealers who ordered as needed inventory with better margins, credits, and rebates over those who placed pre-book orders. Programs look similar for 2025, but the deadlines are earlier. We want to ensure that we are maximizing our margins and available inventory, so we will closely examine preseason programs before placing any orders.

AUSTIN, Texas: Audrey and Mark Sze-To, owners Electric Avenue

Suppliers are offering pre-book programs for 2025, more or less as usual, but without as much pressure to meet quotas and maximize volumes within shipping windows. Our tendency in 2024 going into 2025 has been to increase the ordering of tires, tubes, and other bike accessories and decrease on all bikes across all categories. I predict that we will end 2024 with just the right amount of inventory.

LITTLE FALLS, Minn.: David Sperstad, owner Touright Bicycle Shop

Ideally by the end of 2025 we will have sold our shop and be out riding our bicycles! We will see how sales go, and what we end the year with prior to ordering again for next year. Sales seem to be at or above pre-pandemic levels across the board, accessories in particular. We are hoping to get to on-time ordering — sell one, buy one. I know it's not the greatest strategy, but it has worked for us as we don't have the room for back stock, and we are more seasonal or warm-weather dependent. We tend to slow our ordering around the first of August. We do have a number of e-bikes in inventory, and our state has recently offered a rebate, which has sparked interest and a few sales. Suppliers seem to have as much inventory as we, the shops, do and are willing to work with us on pricing. One supplier has even offered us tremendous terms and free shipping at a selected certain order level.

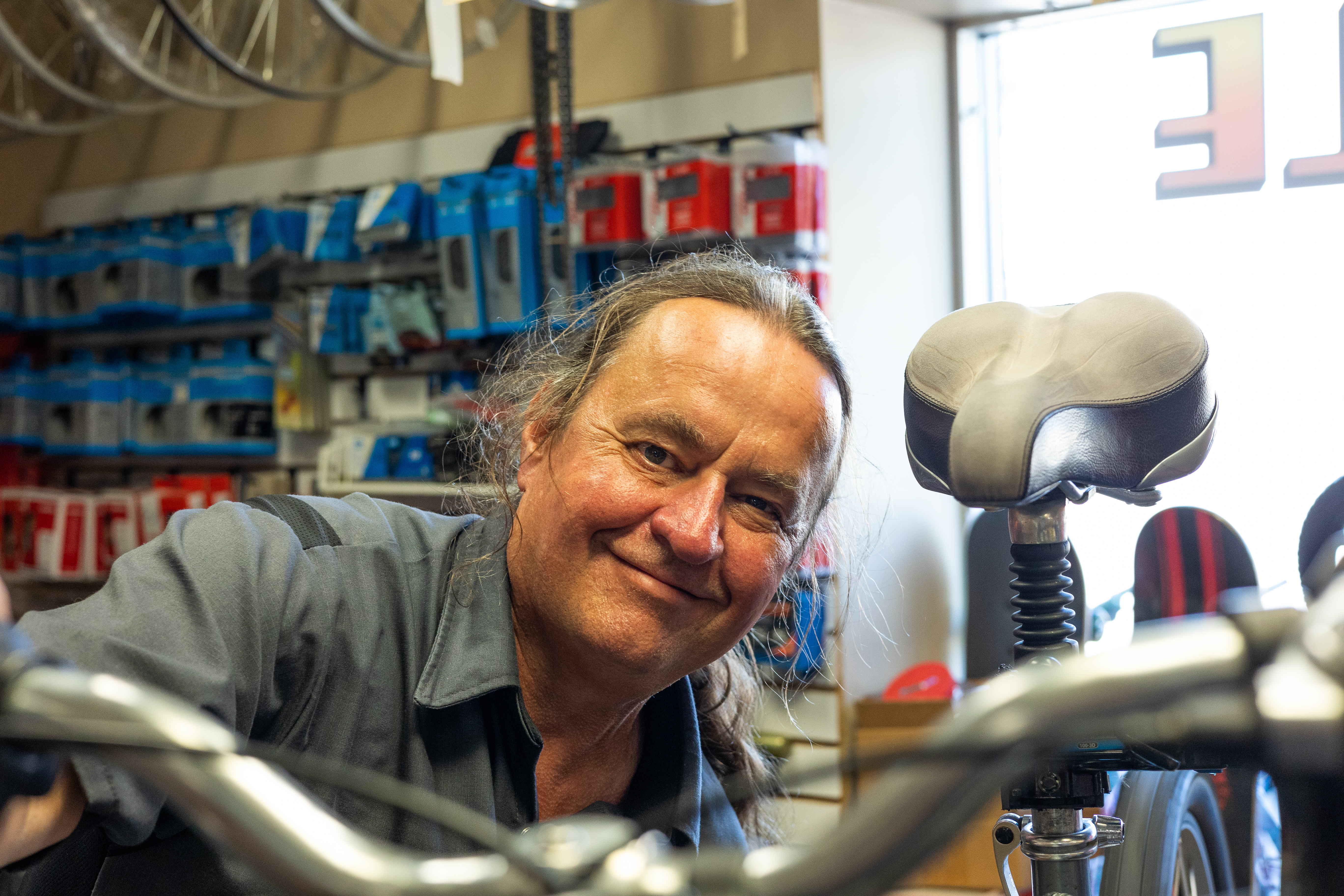

ALAMEDA, Calif.: Larry Tetone, event coordinator Alameda Bicycle

We’ve been working hard the last 18 months to right size our inventory. We cleared out a lot of excess mountain bikes and various new-to-our-shop brands that we brought in during the pandemic to shore up supply. I really value the brands we work with that emphasize bikes on demand — eschewing traditional pre-books and leveraging ordering as needed. I think the whole industry is chasing the dream of being just right in terms of supply levels. I’m pretty optimistic we’ll end the year with the right amount of inventory, and for next year’s ordering, we’ve been bullish on e-cargo, and we’ve reduced our mountain category to specific models that do well for us. This means a lot less full-suspension. There’s definitely been a shortage on the supply side of comfort bikes for us.

This year, it feels like there’s a lot more effort from some brands to saddle us with more inventory faster in exchange for rebates. This might have been beneficial previously, depending on our capacity to excess merchandise; however, with recent trends of manufacturers aggressively changing MAPs and advertising steep sale pricing, I don’t have a lot of purchasing confidence. I wish these large pre-book requests would come with some sort of price protection or a rebate system if a brand really gets underwater with a specific model and needs to start moving product.